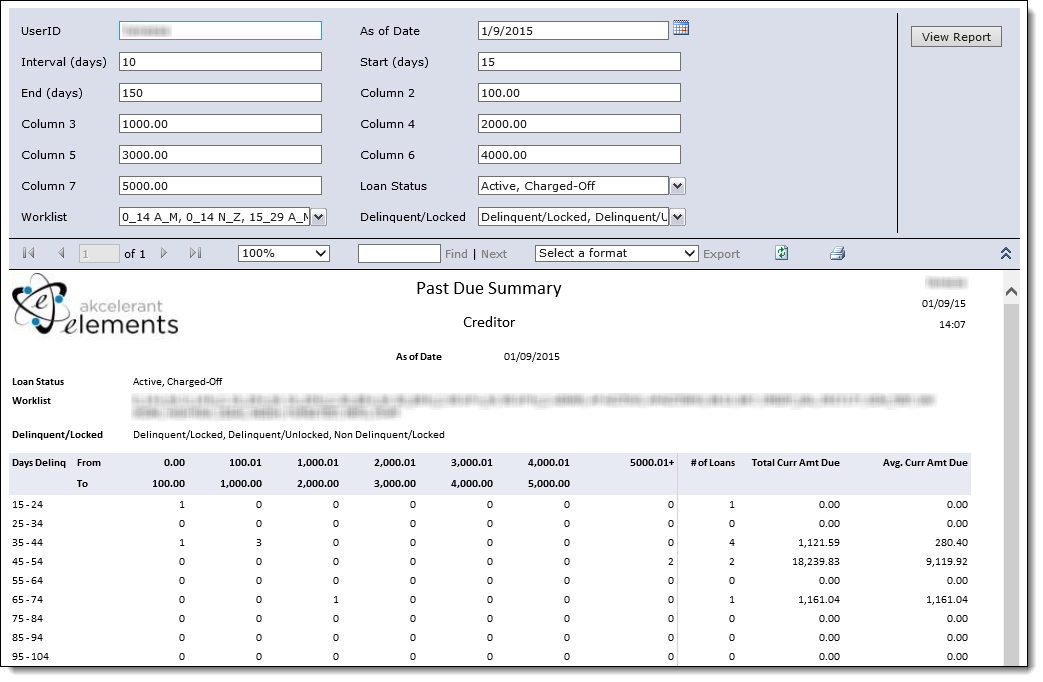

The Past Due Summary Report divides active loans into categories based on days delinquent and lists a count of the number of loans and the total amount due for each category. Typically this report is generated as of the current date, however, this report can be used to project delinquencies for a future date. A projection report displays the projected delinquency values (balance, amount due and days delinquent) as of some future date. This projection assumes that:

- All loans that are delinquent at the time of printing will remain delinquent.

- No new loans become delinquent.

- Any promises to pay that are due on or before the As of Date will be kept.

|

All loans that are delinquent at the time of printing are included in this report even if there is an outstanding promise that will, if kept, make the account current. |

|

Access to this report is controlled through administrator-defined Security Profiles. |

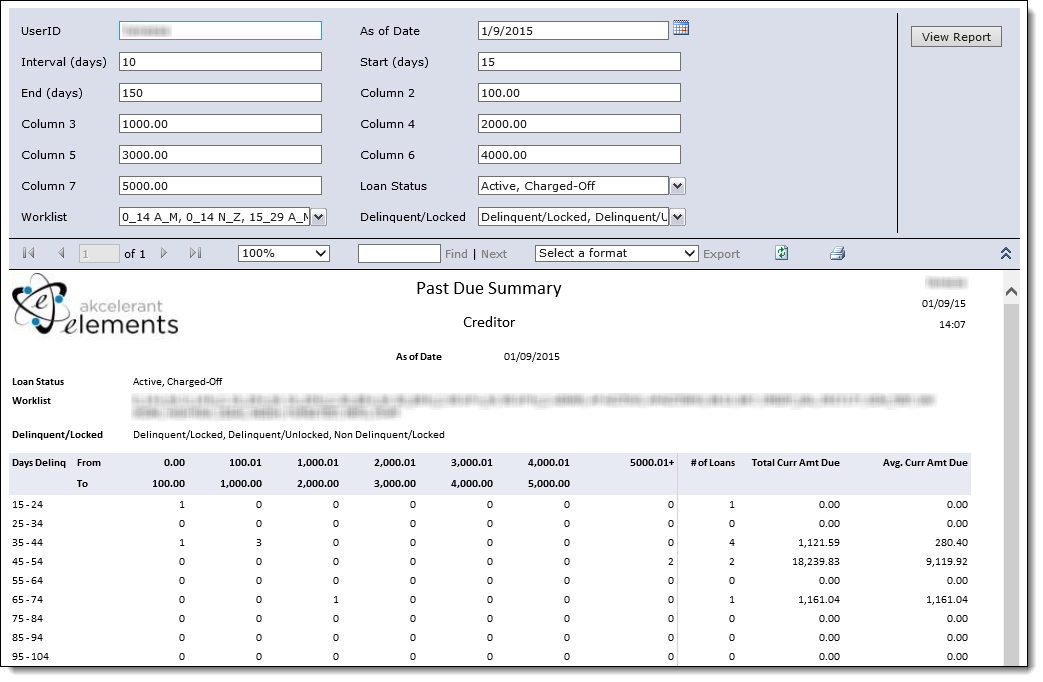

The report is generated with the following filters.

| Filter |

Description |

| User ID |

By default, the user that is running the report appears in this field. If desired, enter a new User ID to include in the report results. |

| As of Date |

By default, today's date is populated in this field. If desired, use the calendar icon to select a new date to be included in the report results. Information is included in the report as it appeared in Elements that day.

|

Set a later date (e.g. the end of the month) to project how delinquent the accounts will be on that date. |

|

| Interval (days) |

Enter the number of days used to define the days delinquent categories. For example, if 10 is entered, the categories are separated in groups of 10 (15-24 days delinquent, 25-34 days delinquent, and so on until the End value is reached). |

| Start (days) |

Enter the number of days to use as the start of the categories. For example, if 15 is entered, the categories start at 15 days delinquent. Days delinquent less than 15 are not included in the report results. |

| End (days) |

Enter the number of days to use as the end of the categories. For example, if 150 is entered, the categories end at 150 days delinquent. Days delinquent greater than 150 are not included in the report results. |

| Column 2 - 7 |

In each Column field, enter the amount due values used to define the report columns.

|

The first column is for accounts with a current amount due from zero to the amount listed in column 2 (e.g. 0 to 100.00). The second column is for accounts with an amount due greater than the value in column 2 and less than or equal to the value in column 3 (e.g. 100.01 to 1000.00). |

|

| Loan Status |

From the drop-down, select the loan statuses to include in the report results. |

| Worklist |

From the drop-down, select the worklists to include in the report results. Loans in the selected worklists are included in the report results. By default, all worklists are selected.

|

Users may be restricted to their own worklists depending on configuration of their Security Profile in System Management >Collection > Security Profiles. |

|

| Delinquent/Locked |

From the drop-down, select the delinquent and locked statuses to include in the report results. |

Change any of the filters and click View Report to regenerate the report using the new parameters.

Refer to the Reports in Elements topic for information on the report's toolbar.